What is CareShield Life?

CareShield Life is a long-term care insurance scheme for persons who become severely disabled for whatever reason. The care insurance scheme allows them to receive monthly payouts which makes the cost of essential care more affordable. It is a lifetime payout as long as the individual continues to meet the eligibility requirements.

If you are unsure if you and/or your loved one should make a claim under CareShield Life, you can head over here to learn more about the various financial assistance schemes available.

What are the eligibility requirements?

-

Be a CareShield Life policy holder

In order to make a CareShield Life claim, one must be a CareShield Life policy holder.

For Singaporeans and permanent residents born in 1980 and later, they are automatically placed under the CareShield Life scheme from 1 October 2020 onwards or after their 30th birthday, whichever comes later.

For Singaporeans and permanent residents born in 1979 and earlier, they have the opportunity to join the CareShield Life scheme from end-2021 onwards as long as they are not severely disabled yet.

-

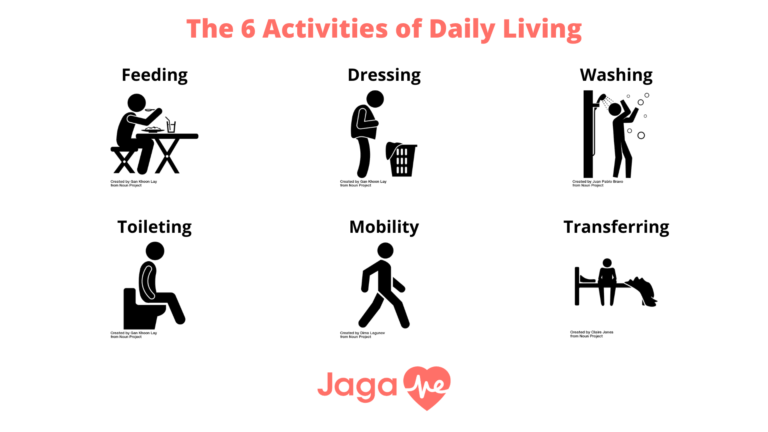

Require Assistance with Activities of Daily Living (ADLs)

In order to make a CareShield Life claim, one must be deemed severely disabled. This means that they are unable to do at least 3 out of 6 activities of daily living without assistance.

The severity of one’s disability can be determined through a severe disability assessment which is conducted by an MOH-accredited disability assessor.

How do I apply for CareShield Life?

Step 1: Undergo a severe disability assessment

You will need to book an appointment with an MOH-accredited disability assessor who will either assess you at his/her clinic or at your own home.

The first severe disability assessment is free, even if you are deemed to not be severely disabled and the CareShield Life claim is unsuccessful.

However, for subsequent severe disability assessments, you will need to pay the assessor upfront first. Should you be deemed severely disabled, the full amount will be reimbursed to you.

Jaga-Me is an MOH-accredited disability assessor which offers severe disability assessments at home. By having a severe disability assessment at home, much-needed convenience is brought to individuals who have limited mobility.

To book a home-based severe disability assessment at home with Jaga-Me, please click here.

Step 2: Log onto the AIC eService portal (eFASS) using your SingPass

Step 3: Go to the “Apply to Receive Scheme(s) Payout” section and indicate if you are making the claim for yourself or on behalf of a care recipient.

Step 4: Key in the details of the bank account that is to receive the payouts.

It is highly recommended to input the bank details of the care recipient or the bank details of the nursing home in which the care recipient resides.

How do I change my scheme details?

If you wish to change your scheme details, bank details or opt-out of the scheme, you can do so in the “Change in Scheme Details” section which can be found under “Manage My Schemes”.

For recipients living in nursing homes, you will need to approach the nursing home for assistance.

What happens if the care recipient does not have mental capacity?

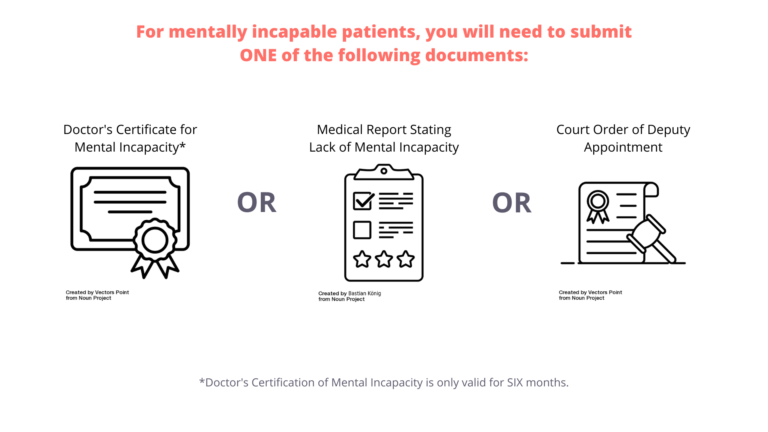

If the care recipient does not have the mental capacity to give consent, a court appointed donee/deputy can give consent on their behalf. The payouts will be suspended if the donee/deputy is not appointed by a court within 12 months of the application’s approval.

Do note that a doctor’s certification for mental incapacity is only valid for six months, unless the condition is stated to be permanent.

Additionally, if the donee/deputy’s bank account is being used to receive the payouts, a copy of their bank book or bank statement must be submitted.

If you wish to change a recipient’s scheme details, bank details or opt-out of the scheme on their behalf, you will need to submit a Mental Incapacity Certification which has been signed by a doctor.

When will I know if my claim is successful?

AIC may take up to 1 month to process your online application. Once they have processed your application, they will inform you in writing of the results and you will begin receiving payouts in the following month if your claim is successful.

For hardcopy applications, the processing time will be longer.