CareShield Life

Everything You Need to Know About CareShield Life

Everything You Need to Know About CareShield Life

Launched on 1 October 2020, CareShield Life is an insurance scheme which helps to cover the cost of long-term care. It replaces the previous ElderShield insurance scheme.

DISCLAIMER: This guide is for informational purposes only. It should not be taken as financial advice. If you are in need of such advice, please approach a trusted financial advisor as they will be able to give recommendations which consider your personal needs and situation.

What is long-term care?

According to Ministry of Health (MOH), intermediate and long term care (ILTC) services are typically required for persons who need further care after being discharged from an acute hospital as well as community-dwelling seniors who may be frail and need someone to watch over them or to help them with their daily needs. An example of long-term care is caregiving services which involve a care aide or trained nurse attending to a patient and assisting them with their daily activities.

How much are CareShield Life payouts?

It depends on when you make a successful CareShield Life claim. The payout amount will start at $600/month and increase as you continue to pay your annual premiums. However, they will remain constant as soon as you make a successful claim.

The following scenarios illustrate how this works:

*This is an estimated figure which is based on the current annual increase of 2%. However, after 2025, the annual increase will be reviewed by the independent CareShield Life Council, thus, this number will likely change in the future.

DO NOTE: CareShield Life payouts support patients for the entire duration that they are severely disabled. Hence, if the patient is permanently disabled, they will receive payouts for the rest of their life. Thus, recipients may need to undergo annual reassessment to check if they are still eligible to receive payouts.

Am I eligible for CareShield Life payouts?

To be eligible for payouts, applicants must meet the following criteria:

They are a CareShield Life policyholder.

Singapore citizens and permanent residents who were born from 1980 onwards, will automatically become a CareShield Life policyholder by the end of 2020 or once they reach the age of 30, whichever is later.

To be specific, those born from 1980 to 1990 will be covered by CareShield Life by the end of 2020 while those born from 1991 onwards will be covered once they reach the age of 30. For these two groups of people, enrolment is compulsory.

Singapore citizens and permanent residents who were born before 1980 and are insured under the ElderShield 400 scheme will automatically become a CareShield Life policyholders in 2021 as long as they are not severely disabled yet. However, they can choose to opt out of the scheme and have their premiums refunded. This must be done before 31 December 2023.

You can head over to the CareShield Life website to check your policy.

They are deemed severely disabled.

The severity of disability is determined by the patient’s ability to do the 6 activities of daily living (ADLs):

If the patient is unable to do 3 out of 6 ADLs, they are deemed severely disabled and are then eligible to make a CareShield Life claim.

However, only MOH-accredited disability assessors can verify and certify the severity of someone’s disability. This is called a severe disability assessment.

This assessment can be conducted in either an assessor’s clinic or in the applicant’s home. As both have their own advantages and disadvantages, be sure to select the location which is more convenient based on your own circumstances.

Jaga-Me is an MOH-accredited disability assessor which conducts home-based disability assessments. This makes it easier for applicants who have difficulty moving or have tight schedules as they do not need to spend time and effort on travelling and waiting in line.

How much are CareShield Life premium?

CareShield Life policyholders pay a base premium depending on their age when they enrol in the scheme. For those enrolling at the age of 30, the base premium is $206 for men and $253 for women. From there, premiums will increase annually in order to support CareShield Life payouts which also increase annually.

From 2020 to 2025, premiums will increase by 2% every year. From 2026 onwards, an independent CareShield Life Council will regularly review the premium adjustments based on factors like:

- Claim Experience

- Changes in life expectancy

- Disbility trends

CareShield Life premiums will need to be paid either until the policyholder is 67 years old (inclusive of the year they turn 67) or until a successful claim is made.

For policyholders who join CareShield Life at the age of 59 and above, they will need to pay CareShield Life premiums for either 10 years or until a successful claim is made.

Do have a look at Annex A of your CareShield Life Welcome Letter to check your premiums and subsidies for your very first policy year. In the future, you can log in here via your SingPass to check your premiums and subsidies.

How can I pay for CareShield Life?

Your MediSave balance can be used to settle your CareShield Life premiums. If you do not have enough money in your MediSave account, your family members (for example, your spouse, children, parents, siblings and/or grandchildren) can help to cover the cost of your CareShield Life policy by either using their own MediSave balance or by topping up your MediSave account with cash.

There are also various subsidies and support measures you can tap on if you require more financial assistance (the government has assured Singaporeans that no one will lose their CareShield Life coverage due to financial difficulties).

These include subsidies and support measures like:

Premium Subsidies

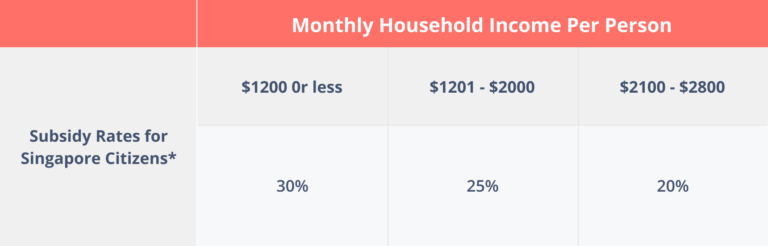

Singapore Citizens and Permanent Residents from lower- to middle-income households can avail of Premium Subsidies. These subsidies can help cover up to 30% of their CareShield Life premiums, however, this amount is subject to your household’s financial situation. You can refer to the table below for more information

*These subsidy rates are only valid for Singapore Citizens who live in properties which have an annual value (AV) of $13,000 or less (This is because properties are also considered financial assets). If you live in a property which has an annual value of $13 001 to $21 000, your subsides will be 10% less than the values indicated in the table. If you live in a property which has an annual value greater than $21 000 or you own multiple properties, you will not be eligible for subsidies. If you are a permanent resident, you will only receive half of the amount indicated in the table.

Transitional Subsidies

All Singapore Citizens who join CareShield Life from 2020 to 2024 can enjoy transitional subsidies of up to $250. To know if you are eligible for transitional subsidies and the amount of subsidies you can enjoy, do check out the table below:

Additional Premium Support

CareShield Life policyholders who still cannot pay after premium subsidies and MediSave, and are unable to reach out to their families for assistance, they can apply for Additional Premium Support.

If the CareShield Life policyholder is unable to apply by themselves the government will assist in the application process.